Blog: Weighted Average Cashflow Obligations - How Rising Rates Affect Buyers' Abilities to Pay Up

Navigating Rising Interest Rates: How it Affects Buyer's Ability to Meet Cash Obligations

Take a $10M hypothetical purchase in June of 2020. Let’s assume this building is operating at a 5 cap today with slight meat on the bone to push to a 5.5 cap through renovations. Going-in, the building produces $500,000 in NOI. The market is a 4.5 cap stabilized for this product, so you walk into a nice positive spread, and you plan to exit in a few years at a 5 cap. Seems conservative to expand the cap 50 bps in 3 years.

To structure this deal, the various funding partners who put up the cash are expecting a return that mimics their risk and position in the capital stack.

Let’s say you, the borrower, secured 70% of the purchase through Fannie or Freddie Mac at 4% (for simplicity, this is the amortizing loan constant). You fund the remaining 30% with equity that commands an 8% return paid current from cashflow.

Will the deal be able to service the total cashflow obligations?

Let’s do some simple math.

70% X 4% = 2.4%

30% x 8% = 2.4%

2.4+2.4= 4.8%

For each dollar of cost, the building must produce 4.8% annually to pay debt and equity partners. We bought a 6% cap so the property will cashflow above that 8% hurdle, providing excess cashflow to equity partners.

Fast forward to April of 2023. Insurance and taxes have risen astronomically. Labor is tight, construction is volatile. For simplicity, let’s just say you want to sell your building. Let’s assume the building produces the same NOI of $500,000/year because rising expenses offset your revenue increases.

You go to sell at your projected 5 cap… but buyers are telling you you’re crazy. Why?

Let’s look at what new buyers’ weighted average cash obligations would be on each dollar of cost.

The buyer can secure new debt at 6.5% (fully amortizing, loan constant) to cover 60% of the purchase price (tightening credit). The remaining 40% is funded via equity now commanding a 9% return paid current (equity wants to be better compensated since they can go get risk free money at 4-5%)

What does this deal need to service annual cashflow obligations?

60% x 6.5% = 3.9%

40% x 9% = 3.6%

3.9+3.6 = 7.5%

Weighted cashflow obligations increased 36% for the new buyer – largely impacting the price they can pay for this asset. To meet those obligations, the buyer can only pay $6,666,666, a 33% spread between the bid of the new buyer, and the expectation of the seller. To pay $10M, the buyer would require $750,000 in NOI to service their cash obligations. That equates to a 50% increase in NOI. Not going to happen.

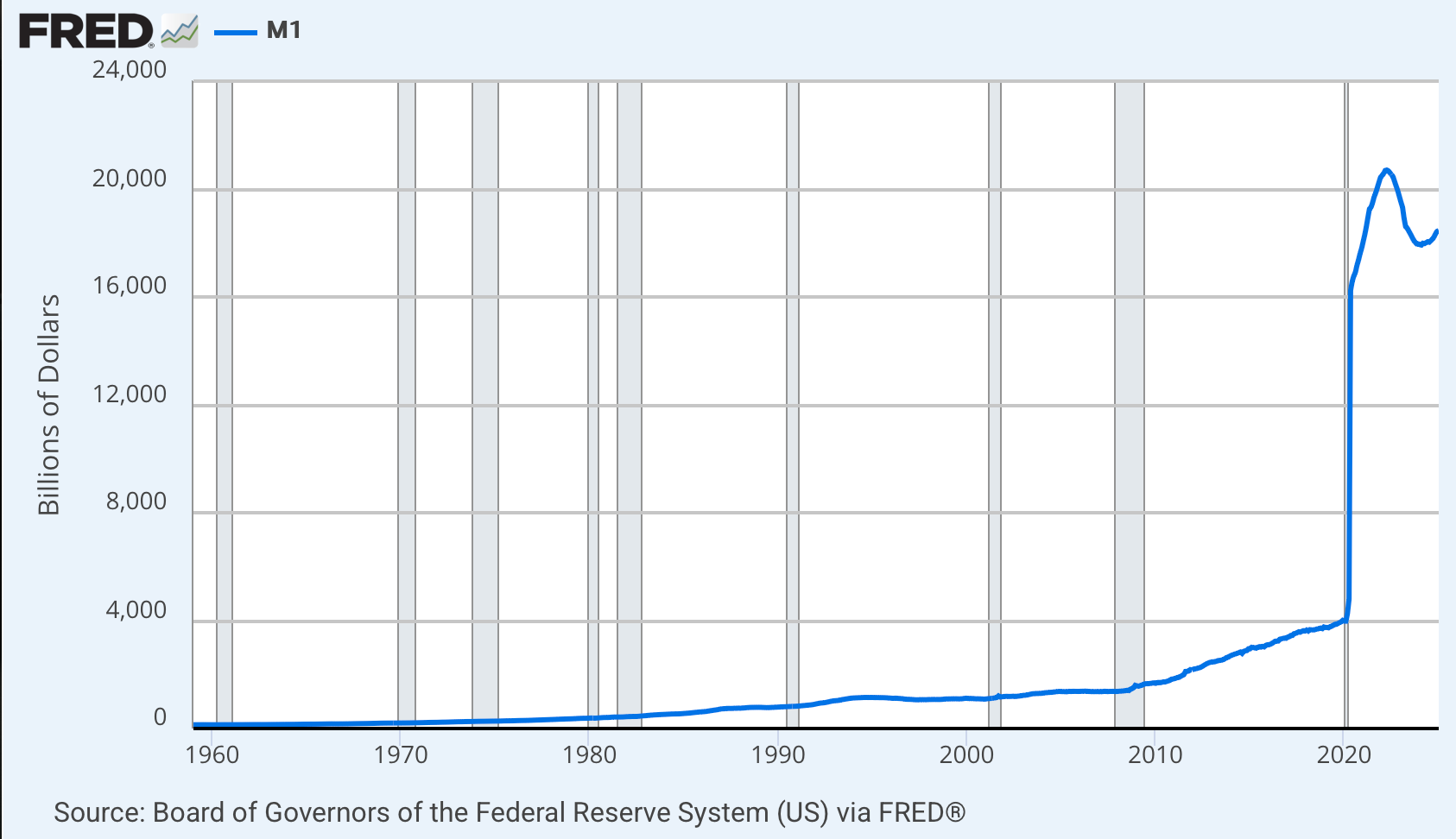

The bid/ask spread is even higher today as treasury rate yields have risen in response to a bigger than expected jobs report & hawkish commentary from the Fed, further stressing permanent financing and floating rate note holders.