Blog: Rent or buy? Trends Point to Outlook for Multifamily Investing

Mortgage interest rates, housing starts, home prices, rent and inflation are all on the upswing. Will consumers find it more attractive in the future to rent or buy? For investment advisors and investors, the answer provides context for a decision to diversify traditional portfolios through multifamily investing. As investors stress test their portfolios and seek higher total returns, multifamily investments can provide a true “alternative” in this regard. But to understand why, it pays to look at the situation from the perspective of prospective tenants and home buyers.

The median home price grew by 34% from March 2020 to March 2022, according to Redfin, and Zillow expects annual home prices to soar another 17.3% by January 2023. The National Association of Realtors (NAR) reported that the median home price climbed 13.4% in just the past year, the highest jump since record-keeping began in 1999. In June, the median sale price of an existing home reached a record $416,000, the NAR reported. Despite these hefty price increases, annual existing home sales reached a 15-year high in 2021.

Renters asking the “rent or buy” question face other hurdles. One is competition for homes from investors and second-home buyers, who accounted for 1 in 6 sales in the NAR yearend report. Another is rising mortgage rates. Interest rates on 30-year mortgages are hovering in the 5% range for the first time since 2010. Even though wages are climbing, rising mortgage interest rates mean the monthly payment on the median house now claims close to one-fourth of the median income. In the Western U.S., it’s well over one-third of income. Families are finding it harder to raise cash for a down payment, with 2 out of 3 U.S. consumers tapping into savings for living expenses.

Gap Between Homeowners and Renters is Shrinking

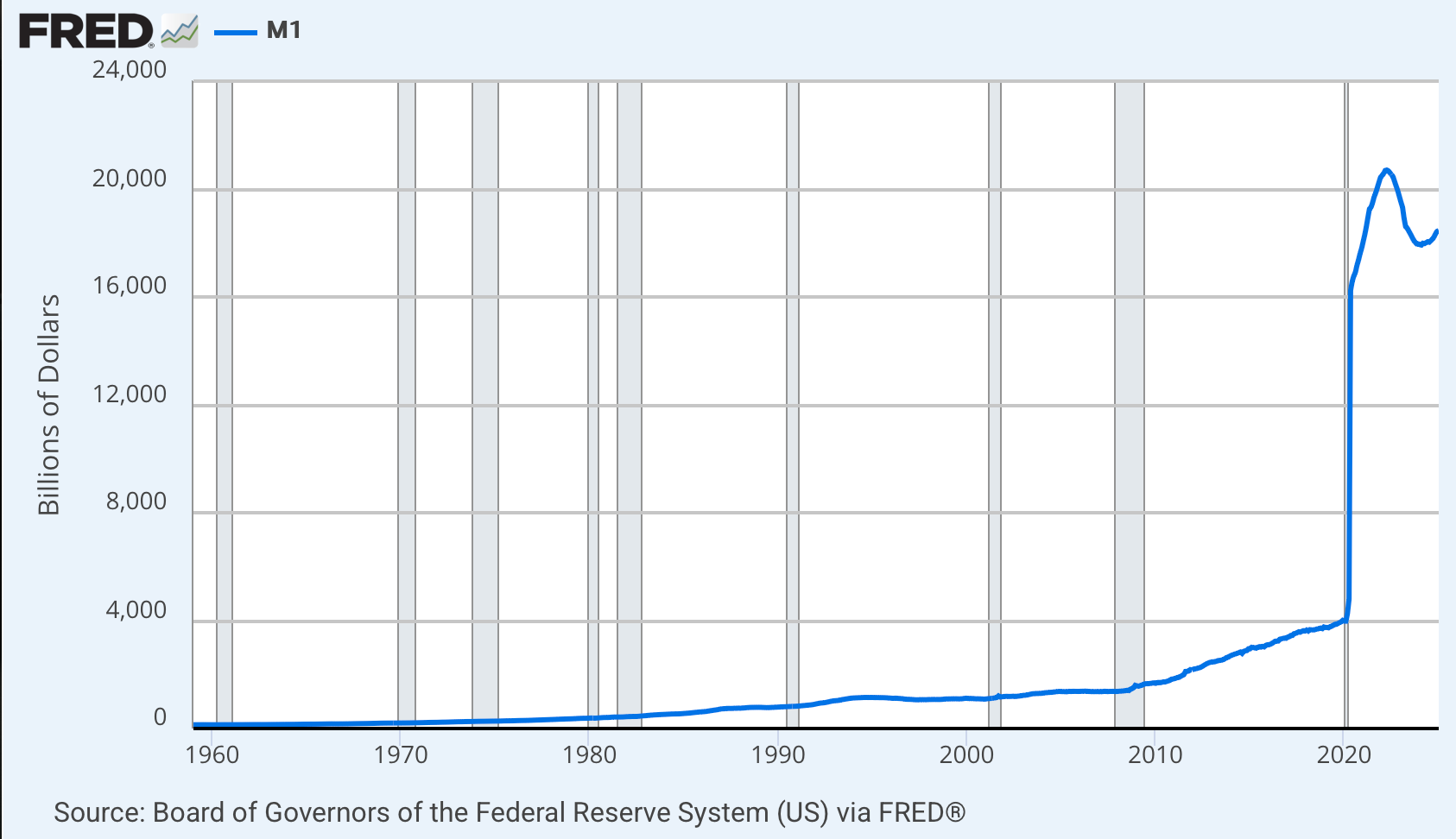

The pandemic may have touched off higher interest rates and inflation, but the economic response to COVID-19 accelerated longstanding housing trends. It also eroded homeownership as a goal. Across age demographics, lifestyle changes now favor the rental market. Millennials face high student debt; they’re still interested in homeownership, just not anytime soon. Gen Z renters have less available net worth for a home purchase, and older adults have few accessible housing choices. For them, the rent or buy options are limited.

While owning a home has long been part of the American dream, U.S. Census Bureau statistics show homeownership declined to 65.5% at the end of 2021, down from 69% in 2004. The Urban Institute expects the rate to fall to 62% by 2040. While there are more homeowners than renters, the gap between them is shrinking as housing costs continue to climb, a July 2022 analysis by iPropertyManagement showed. All age groups are experiencing a decline in homeownership. But those 35 and under had the largest year-over-year decline, the analysis noted.

While millennials, the nation’s largest population cohort, want to buy homes, they don’t have the resources yet. And they may not anytime soon given that home price growth rates are even higher than rent price growth rates, and mortgage rates and financing costs are up 60% year over year, GlobeSt reported in June.

In July 2022, Zumper’s National Rent Index reached an all-time high, with the median rent on a one-bedroom apartment rising 11.3% year over year to $1,450. Two-bedrooms rose 9.3% year over year. But the house that two years ago would have sold for $300,000 now costs $420,000, with a mortgage that’s risen from 3% to 5.5%. The combination adds $1,000 to the monthly payment.

As Rent Rises, So Does Cost of Homeownership

Redfin’s U.S. database suggests how the rent or buy dynamic plays out. The average U.S. monthly rent was $2,016 in June 2022, up $249, or 14%, year over year. With a 5% down payment, Redfin finds the average condo or co-op loan would be $185 cheaper while the average single-family mortgage would be $418 above the average rental rate. Still, property taxes and homeowners’ association fees or home maintenance outlays would push monthly costs much higher.

These numbers make millions of renters a captive rental audience, unable to buy even if willing. Plus, home prices are rising faster than incomes. In NAR’s affordability model, qualifying income for the median single-family home with 20% down is more than $88,000. By those standards, many millennials don’t have the income to buy, while Gen Z renters lack the savings. The number of first-time home buyers fell to 37% in 2021 from 43% in 2020 and may not top 45% until after 2030, according to two Zillow reports.

An economic slowdown is unlikely to close the affordability gap. While recession might bring interest rates to heel, unemployment would leave fewer wage-earners to benefit. In housing cycles, home prices are fast to rise but slow to fall. As interest rates fall, real estate market demand rises, keeping prices high.

Multifamily Real Estate Investment Expected to Climb

A 2022 survey of advisors uncovered a “Goldilocks moment” for alternative investments: Allocations to private real estate and other alternatives had risen to 14.5% of assets, with plans to increase that to 17.5% in the next two years. The results mirror European trends: The London-based AssetTribe platform estimated demand for alternatives to rise as much as 46% in the in the next year. Real estate was the most popular alternative investment, attracting 3 of 4 European Union and United Kingdom investors surveyed. Overall, multifamily investment volume in 1Q 2022 rose 56% year over year, with CBRE tracking a record $63 billion quarter. Investment in the sector totaled 37% of all commercial real estate investment.

Neither economic headwinds nor coronavirus disruptions have dislodged high multifamily real estate valuations. In its multifamily real estate outlook, Fannie Mae expected above-average demand both in the next few months and as new Class A buildings are completed in 2023. iPropertyManagement’s analysis of industry data found rental demand will climb over the next five years.

Bottom line: Trends indicate that strong rental demand is likely to persist for years. That forecast should encourage continued multifamily investment.